Welcome to our monthly breakdown of viewership statistics with MedBud.wiki, taking a deeper look at UK medical cannabis data for July 2024. Each month we delve into the monthly traffic data to highlight trends and enhance understanding of the emerging market. This month saw an impressive 10.3% increase in overall traffic data, marking a 9% jump from June. This significant rise suggests the market is continuing to grow with more of the public seeking to learn more about the medical cannabis market here in the UK.

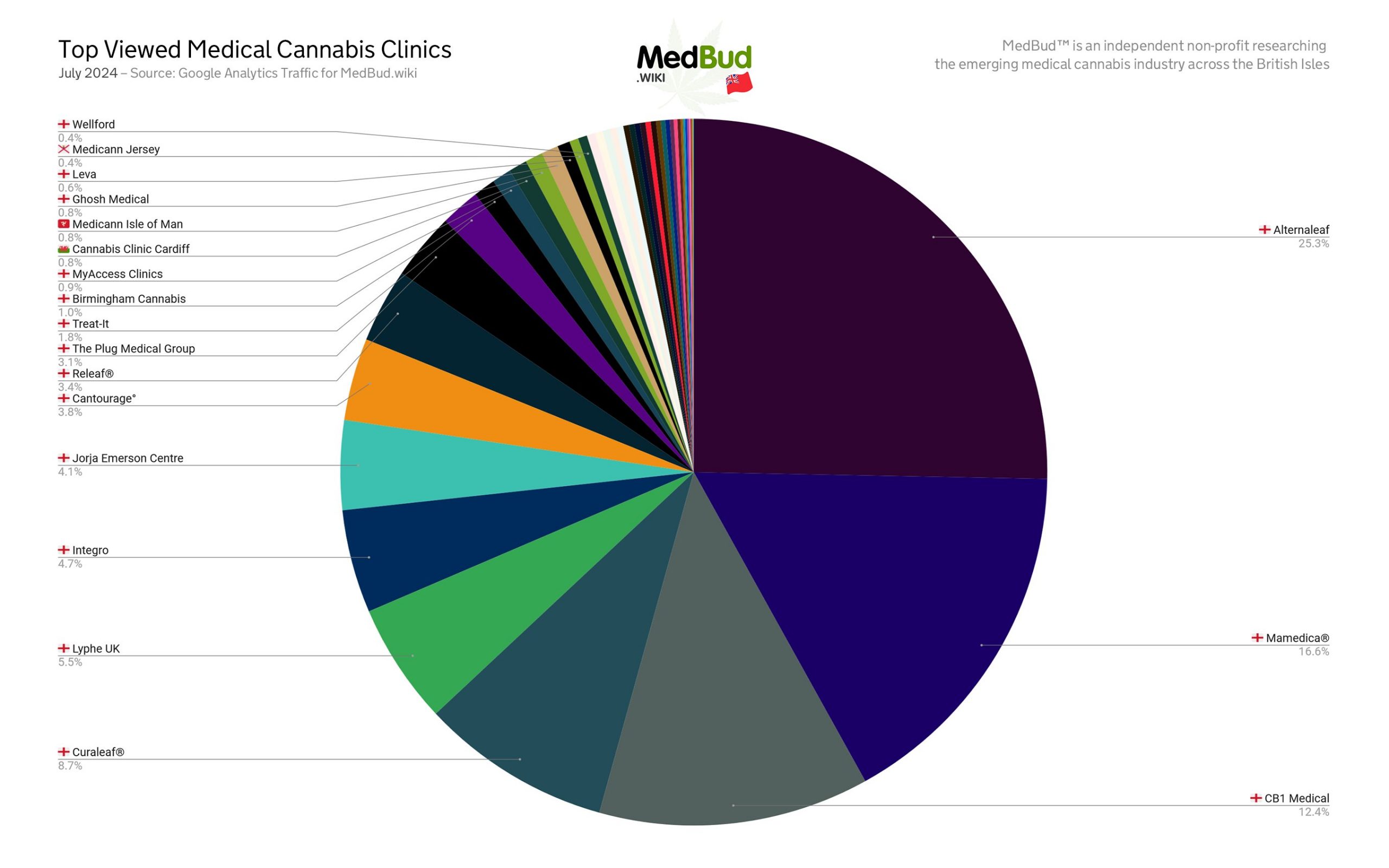

Section 1: UK Medical Cannabis Clinics Data

July Clinic Rankings

- Alternaleaf: 25.3% (9% increase)

- Mamedica®: 16.6% (+1)

- CB1 Medical: 12.4% (-1)

- Curaleaf®: 8.7% (–)

- Lyphe Clinic: 5.5% (+1)

Alternaleaf has not only solidified its lead since taking the top spot last month but has also seen a 9% increase in traffic overall. It appears their pricing structure and monthly membership scheme, mentioned in last month’s data, have helped them retain the top position. Mamedica has climbed back to second place, displacing CB1 Medical to third. Curaleaf remains stable in fourth, while Lyphe Clinic has moved up to fifth, pushing Integro down to sixth.

Reflections

The top five clinics accounted for 68.5% of all site traffic this month, up from 63.7% last month. This concentration suggests that the clinic market is dominated by a small number of providers. Alternaleaf’s significant increase in traffic indicates the success of their recent pricing structure and membership programme, reflecting the growing trend of subscription-based offers across the sector.

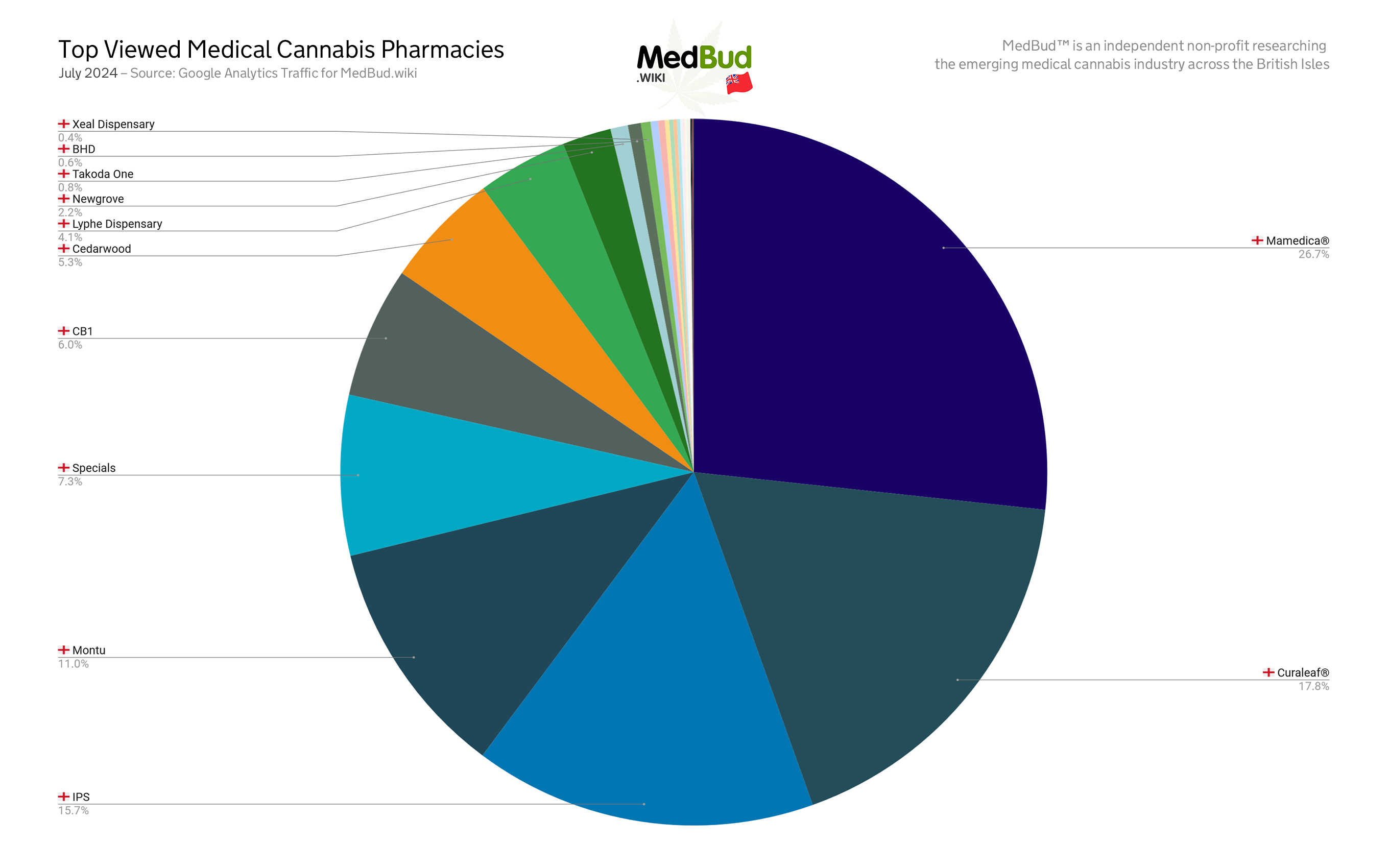

Section 2: UK Medical Cannabis Pharmacies Data

July Pharmacy Rankings

- Mamedica®: 26.7% (–)

- Curaleaf®: 17.8% (–)

- IPS Pharma: 15.7% (–)

- Montu: 11% (+3)

- Specials Pharma: 7.3% (-1)

The top three pharmacies have remained unchanged. Montu retains its fourth place after climbing from seventh last month.

Reflections

For the third month in a row, pharmacy traffic appears stable and predictable. Each of the top five has clear reasons for their current positions. To capture a sizable share of the medical cannabis market, pharmacies need to offer either an exceptionally large formulary or have strong links with top-performing clinics.

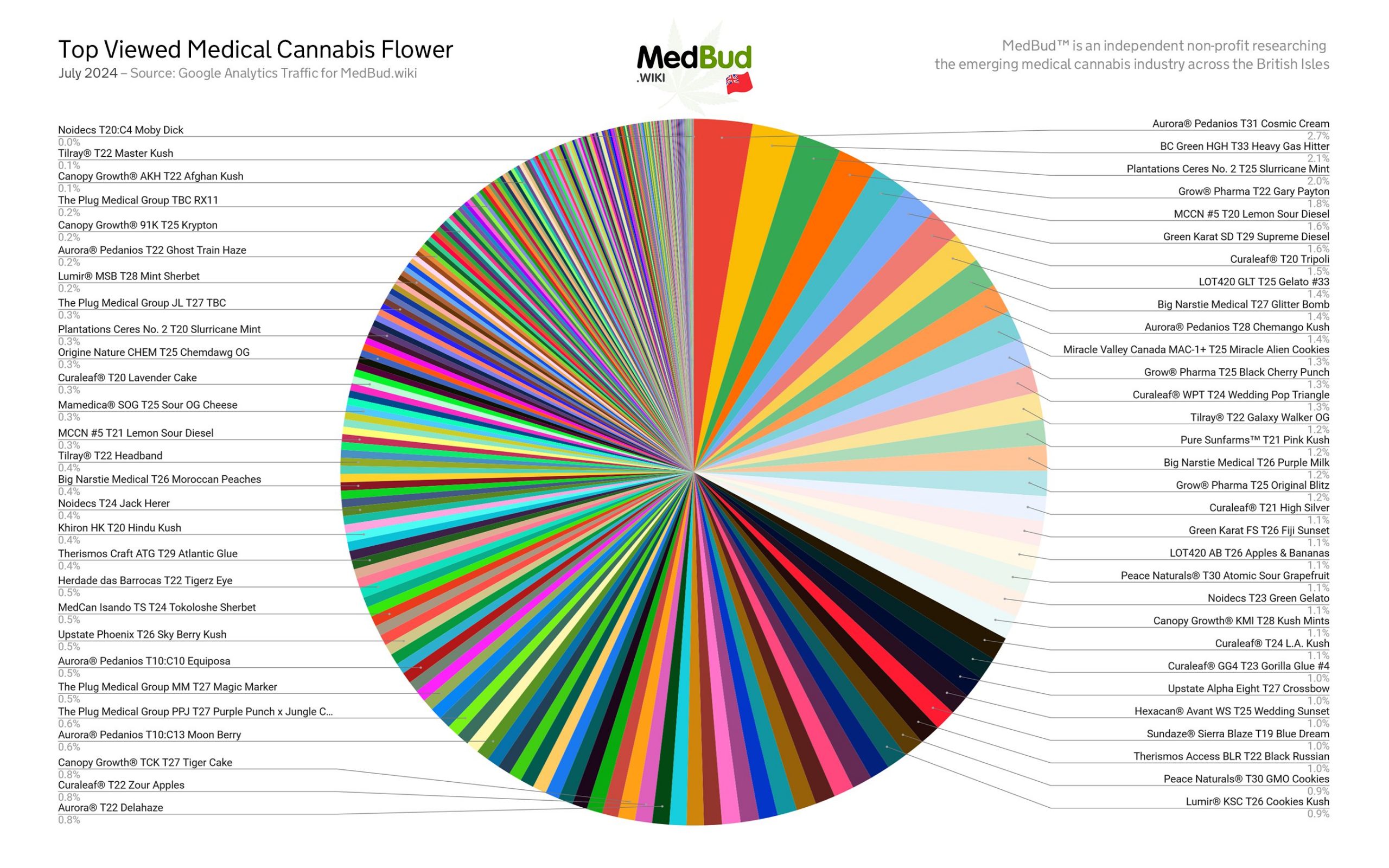

Section 3: Medical Cannabis Flower Data

July Flower Rankings

- Aurora T31 Cosmic Cream: 2.7% (new entry)

- BC Green T33 HGH: 2.1% (+2)

- Plantations Cérès T25 Slurricane Mint: 2.0% (new entry)

- Grow Pharma T22 Gary Payton: 1.8% (+1)

- MCCN T20 Lemon Sour Diesel: 1.6% (+140)

Aurora’s newly released T31 Cosmic Cream has taken the top spot, followed by BC Green T33 HGH, which climbed two places. Plantations Cérès T25 Slurricane Mint, a new entry, captured the third position. Last months top spot Big Narstie Medical T27 Glitter Bomb has dropped down to 10th while the June’s second placed Aurora® Pedanios T27 Farm Gas is down to 36th.

Reflections

The flower market remains highly competitive, with new and restocked strains quickly gaining popularity. High-THC products continue to dominate, reflecting patient preferences for potent therapeutic options. The dynamic nature of the flower market highlights ongoing interest in exploring new and effective products.

The top viewed flower also seems dominated by those that gain notoriety via patient groups and social media, with two of the top ten having purportedly had issues with seeds this month.

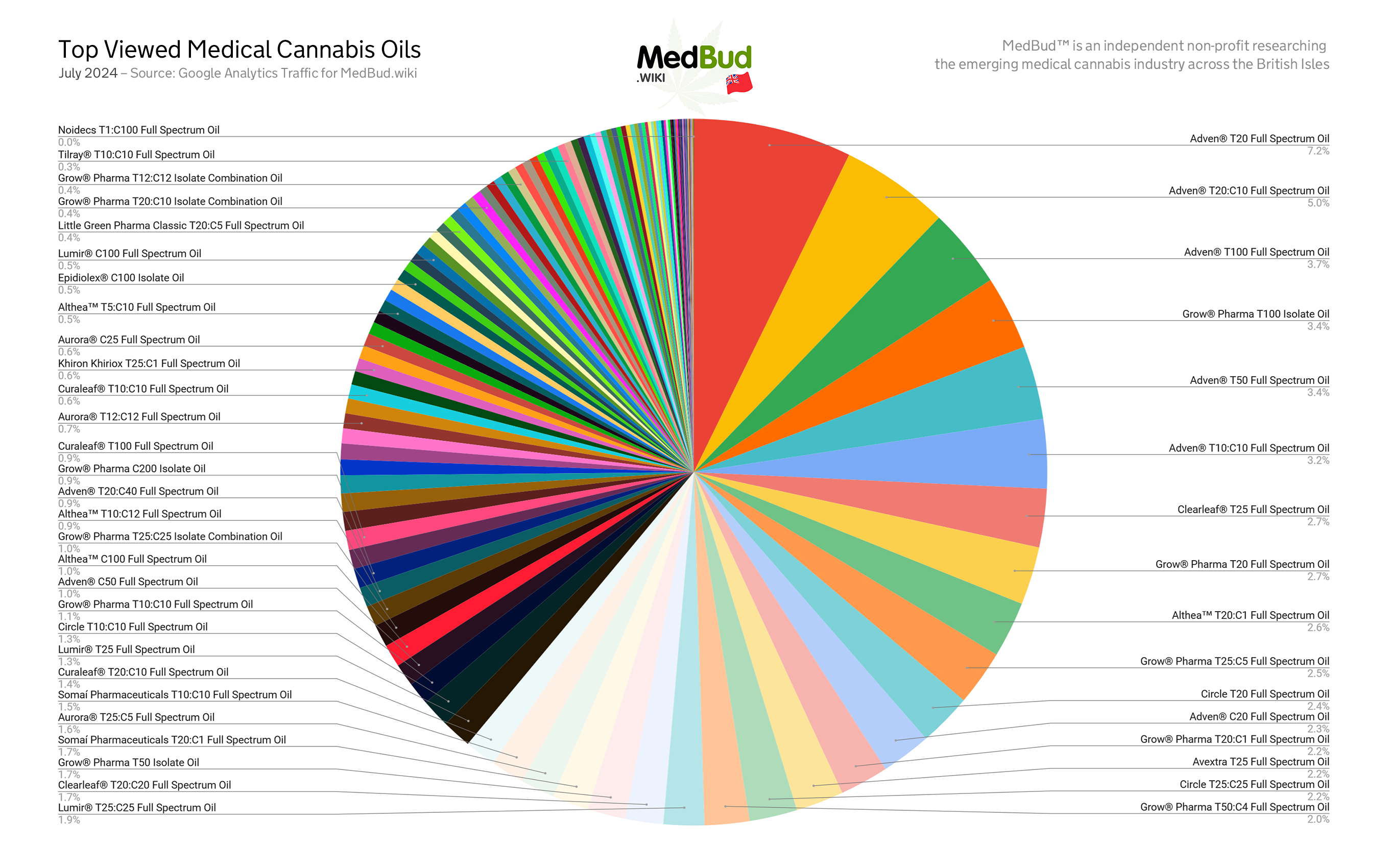

Section 4: Medical Cannabis Oils Data

July Oil Rankings

- Curaleaf T20 Full Spectrum Oil: 7.2% (–)

- Curaleaf T20:C10 Full Spectrum Oil: 5% (+2)

- Curaleaf T100 Full Spectrum Oil: 3.7% (-1)

- Grow Pharma T100 Isolate: 3.4% (–)

- Curaleaf T50 Full Spectrum Oil: 3.4% (–)

Curaleaf’s rebranded oil range continues to dominate the market. Grow Pharma T100 climbed two positions into the top five, with three of their oils now in the top ten. Mamedica’s Clearleaf T25 also made its first appearance in the top ten.

Reflections

The oil market remains stable with minimal changes in rankings, reflecting established patient preferences for trusted brands. The dominance of Curaleaf’s range indicates a strong market presence and consistent product quality.

Final Thoughts

The 10.3% jump in overall website traffic is encouraging and aligns with the general industry sentiment that the market is growing rapidly in the UK. Although the market is still in its early stages, there is clear growth, and industry sentiment suggests we are heading in the right direction. Subscription offers have become standard practice, helping to increase the patient cohort through more reasonable pricing models. Cost has long been one of the main issues facing patients, so flexibility with payments is a positive step for the industry.

The flower market remains exceptionally competitive, indicating that a significant portion of medical cannabis patients in the UK are eager to try new cultivars regularly. This constant flux can be challenging for growers aiming to establish a stable presence in the market. The growing number of reviewers and commentators on social media over flower quality and experience is clearly impacting on the market.

In contrast, the clinic rankings hold no surprises as a small number of companies continue to dominate in terms of traffic. These clinics are clearly contributing to market growth through substantial investments in marketing, PR, and SEO. For smaller clinics lacking the same budgets and supply chains, this is a tough market to crack. However, the overall increase in traffic suggests that the market is expanding thanks to their continued efforts. It might be a challenging few years for smaller clinics, but the growing market presents opportunities for those that can adapt and innovate.

For further detailed statistics and insights, visit MedBud and Volteface.