Welcome to August’s analysis of the MedBud traffic data. The most interesting month we have had yet, and a clear sign that the data we analyse provides a real time accurate representation of how the sector is performing. In terms of the MedBud site it currently averages over a million monthly search result impressions via Google, with 57.7k clicks through for August. In general traffic increased by 1.8% for the month compared to July. Another impressive month for the site.

As suspected we have seen some big shift among the clinics rankings and a continued dominance of high THC strains in the flower traffic. It is no secret that the sector has some challenges ahead, particularly around THC strength and strain names. This data and analysis will play out on Volteface and MedBud in the coming months, so make sure you bookmark both sites and follow us across social media.

Section 1: UK Medical Cannabis Clinics Data

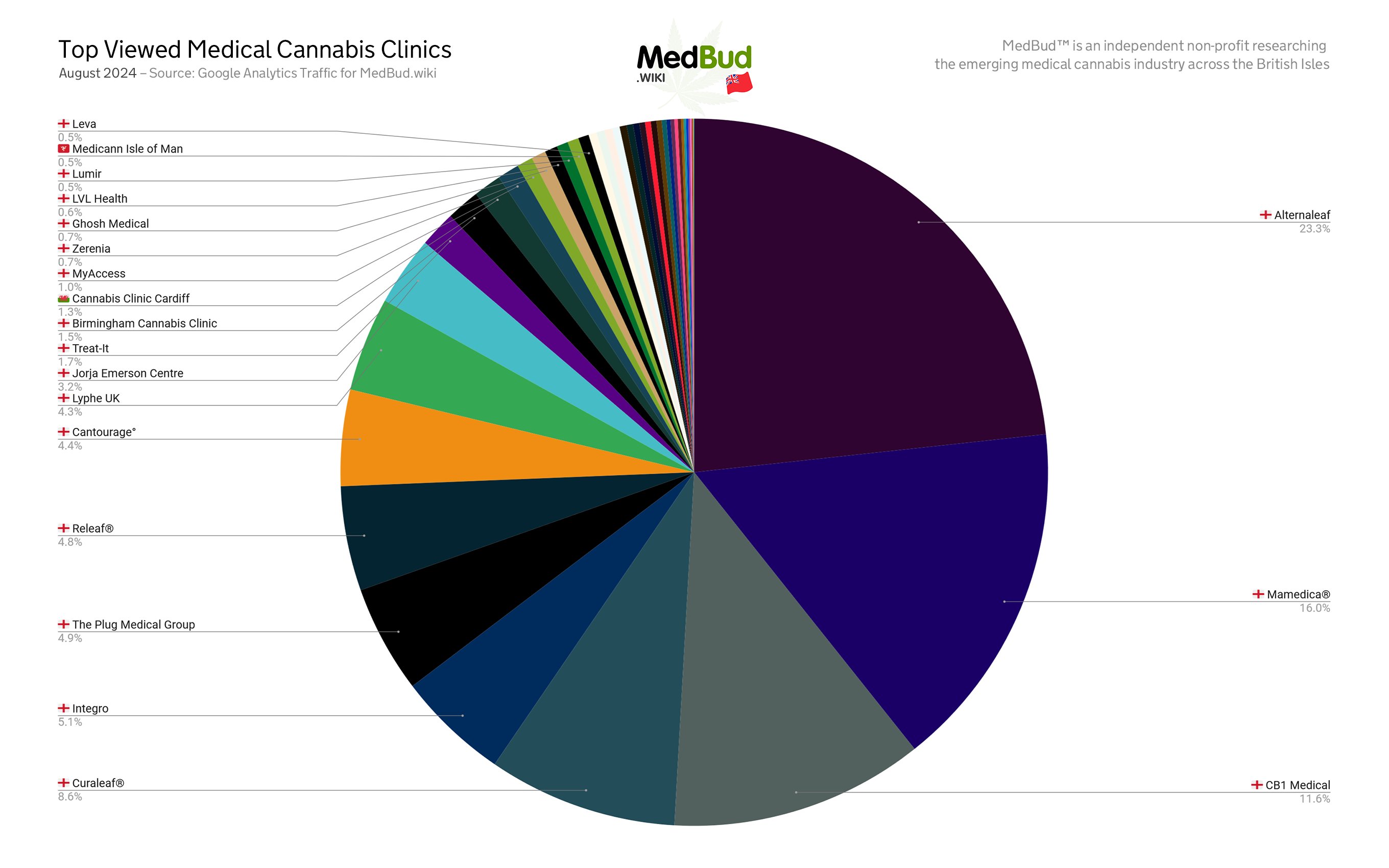

Top 5 Clinic Rankings for August 2024:

- Alternaleaf®: 23.28% (-)

- Mamedica®: 16.01% (-)

- CB1 Medical®: 11.59% (-)

- Curaleaf®: 8.64% (-)

- Integro®: 5.12% (+1)

Alternaleaf, Mamedica®, CB1 Medical, and Curaleaf® held the top four positions from July, continuing to dominate clinic traffic. Integro climbed from 6th to 5th, pushing Lyphe Clinic down to 9th. A big drop for Lyphe Clinic who after a solid few months with the launch of their subscription offer appear to be falling away and out of favour, with Alternaleaf now undercutting them.

Jorge Emerson Centre dropped from 7th to 10th, likely due to their poorly received (and in my opinion poorly framed) ‘patient statement’ which failed to accept the concerns being raised by patients online about their service. Both Lyphe Clinic and Jorge Emerson Centre need to quickly reassure patients around the quality and stability of their offer before more patients leave for other clinics.

Reflections

The top three clinics have really cemented themselves in the rankings with Alternaleaf holding the top spot by some way for two months running. There are now 45 medical cannabis clinics on the database, 35 of which fail to receive more than 1.6% of the total traffic.

A few interesting additions to the top 10 this month, the newly launched and boldly named The Plug Medical Group has taken the 6th spot this month with Releaf coming in at 7th. Two groups who have the potential to upset the well established top 5.

August saw no attempted traffic bot manipulation which was welcome news and a positive sign such tactics are at an end.

Section 2: UK Medical Cannabis Pharmacies Data

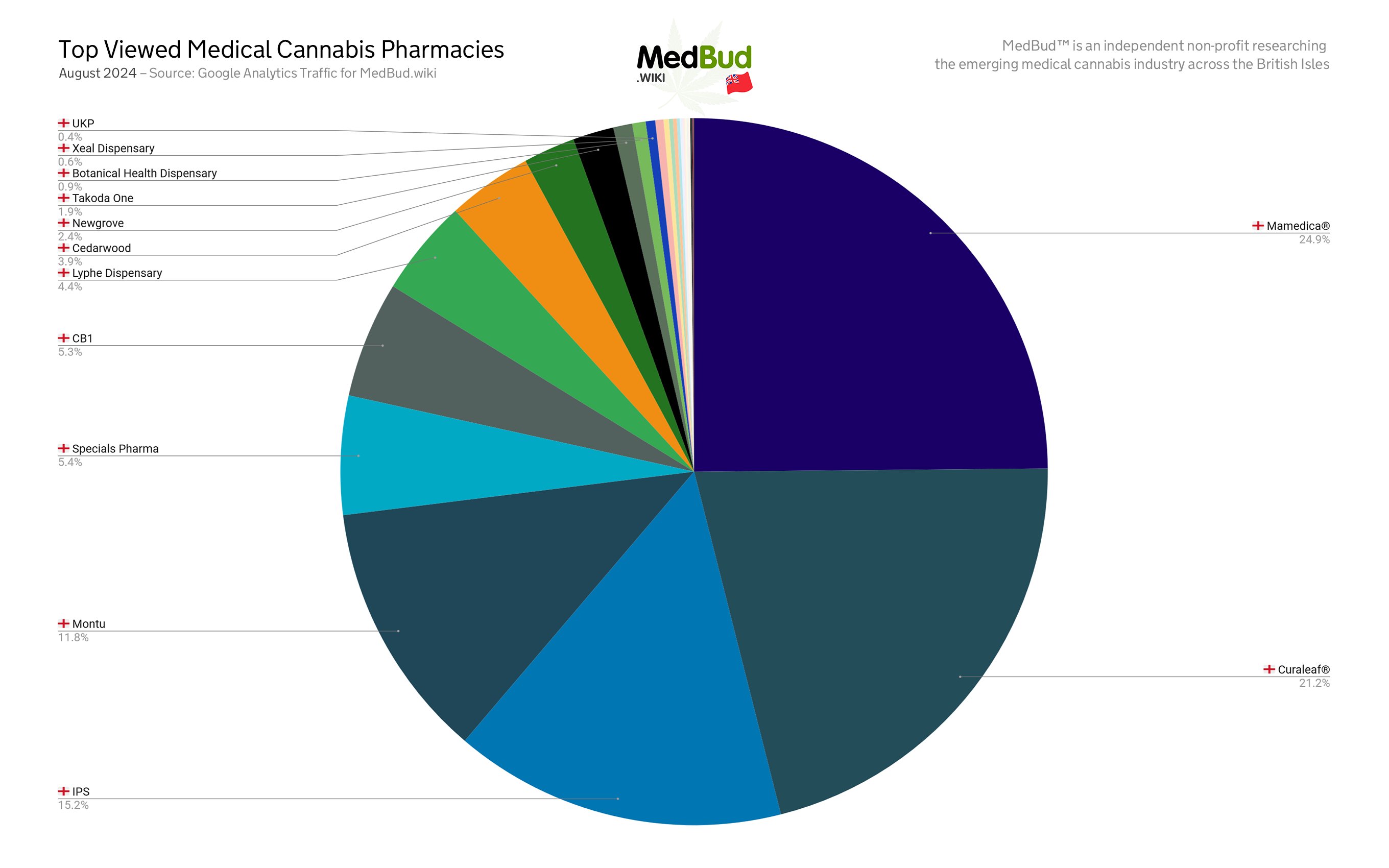

Top 5 Pharmacy Rankings for August 2024

- Mamedica®: 24.85% (-)

- Curaleaf®: 21.19% (-)

- IPS: 15.17% (-)

- Montu®: 11.80% (-)

- Specials Pharma®: 5.43% (-)

Mamedica® retained the top spot, but saw a slight decline in share from 26.7% to 24.85%. Curaleaf closed the gap, increasing its share to 21.19%. IPS and Montu remained consistent, while Specials Pharma held its 5th place despite losing some traffic.

Reflections

The pharmacy sector saw Curaleaf® edging closer to Mamedica® in August. The consistency among the top five pharmacies suggests strong patient loyalty, while smaller players are finding opportunities to increase their market share. Mamedica continues to demonstrate the power of a high PR spend (or at least a deal with an agency) and they secure mainstream coverage on a monthly basis. Anyone who wants to break into the clinic or pharmacy space and overtake Mamedica will need a punchy PR and marketing budget.

Section 3: Medical Cannabis Flower Data

Top 5 Flower Rankings for August 2024

- Aurora® Pedanios T31 Cosmic Cream: 2.66% (-)

- Tyson 2.0 TM T28 Tiger Milk: 2.62% (+49)

- Curaleaf® T21 High Silver: 1.85% (+16)

- Aurora® Pedanios T27 Pink Diesel: 1.63% (+34)

- Tyson 2.0 HH T28 Haymaker Haze: 1.51% (+60)

Distributor Analysis:

Number of products in the top 20:

IPS Pharma: 11

Curaleaf: 6

Cantourage: 2

CanMart: 1

Aurora® T31 Cosmic Cream held its lead, while Tyson 2.0 products saw rapid growth, occupying 2nd, 5th, and 11th positions. Curaleaf® T20 Tripoli slipped from 7th to 8th, while T21 High Silver and T20 Lavender Cake re-entered the top 10.

Reflections

The flower market is often dominated by new strains hitting the market so it is interesting to see both T21 High Silver and T20 Lavender Cake make significant jumps into the top 5. Having said that, the flower market (unlike the clinic market) is exceptionally competitive with just 1% separating 2nd and 29th.

The flower market is going to come under increasing scrutiny in the coming months due to disruptive journalism, including a potential BBC Panorama documentary, and a potential CQC inquiry. High THC strains are consistently the most popular choice for patients (not just here in the UK but globally) and it is important concerns around their potency take into consideration patient choice and experience.

Keep an eye on www.volteface.me for more discussion, reflection and analysis as this unfolds.

Section 4: Medical Cannabis Oils Data

Top 5 Oil Rankings for August 2024

- Curaleaf® T100 Full Spectrum Oil: 4.24% (+2)

- Grow® Pharma T100 Isolate Oil: 3.46% (+3)

- Curaleaf® T50 Full Spectrum Oil: 3.42% (+3)

- Curaleaf® T20:C10 Full Spectrum Oil: 3.28% (-1)

- Somaí Pharmaceuticals T20:C1 Full Spectrum Oil: 2.74% (+16)

Curaleaf® T100 Full Spectrum Oil remained the top oil, continuing its dominance in the category. Grow® Pharma T100 Isolate Oil stayed in 2nd place, reflecting strong demand for isolate formulations. Somaí Pharmaceuticals T20:C1 Full Spectrum Oil made a significant entrance into the top five for the first time.

Reflections

August saw more changes than usual in the oils category, partly due to Curaleaf® rebranding its Adven® oil range to Curaleaf®. Somaí Pharmaceuticals and Circle by Montu both entered the top 10 for the first time, showing growing patient interest in balanced cannabinoid formulations. Meanwhile, Althea and Clearleaf® by Mamedica® narrowly slipped out of the top 10, and GrowPharma lost two of its previous three top 10 positions this month, reflecting some shifts in patient preferences.

Final Thoughts

The August 2024 data shows interesting changes across all of the data points. In particular the changes to the clinic rankings. It is vital that in a small and competitive market in which such high levels of online discussion and debate occur, clinics carefully consider their communications strategy. It is vital that patients’ concerns are heard and engaged positively and heard, unfortunately with Jorge Emerson Centre I feel the patient backlash is now being felt (and represented in the rankings).

Lyphe Groups fall also shows signs some change is likely needed to cement a top 5 spot. Their recent subscription model was well received but since announcing it their traffic has dipped month on month.

On the flower side IPS Pharma dominates in terms of the number of ‘top 20’ strains they distribute – currently holding over 50% (11) of the list. We will keep an eye on how other distributors do in the coming months and include this as a regular feature in the report.

The coming months a debate on strain names and THC potency is likely to play out. This data and similar reports will be valuable in not only better understanding patient preference, but being able to observe a real time impact on the market. We will forward to bringing you next months, in the meantime keep an eye on Volteface and MedBud.