Welcome back to our second edition of the viewership statistics breakdown with MedBud.wiki, taking a deeper look at UK medical cannabis data for June 2024.

Like last month, we take a closer look at the monthly traffic data and highlight interesting trends to improve the sector’s understanding of the emerging market.

Compared to last month’s whooping 18.5% increase in traffic, this month only saw a 1% increase in overall traffic in the last 30 days. Though overall there was less media coverage this month, with the build up of Cannabis Europa, we would have expected to see greater traffic growth.

Despite a decrease in the amount of growth we are seeing in MedBud’s traffic, it’s still going in the right direction. As we continue to see more mainstream media coverage and new initiatives announced in the sector, we are likely to see sustained growth. But now, without further ado let’s get into the stats.

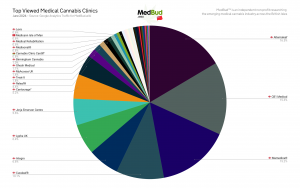

Section 1: UK Medical Cannabis Clinics Data

June Clinic Rankings

June Clinic Rankings

- Alternaleaf: 16.5% +4

- CB1 Medical: 15.3% –

- Mamedica®: 15.3% -3

- Curaleaf®: 10.1% –

- Integro: 6.6% +1

This month we’ve seen a dramatic rise for Alternaleaf from 5th to 1st place. This is likely due to their new pricing structure launched earlier this month. They have dropped consultation fees from £49 to £39. Alternaleaf also launched a £15 monthly membership inclusive of all consultations and repeats at a total cost of £180 per year.

As a result, for the first time in months Mamedica® has been displaced from the top clinic spot and CB1 Medical has also overtaken them to 2nd place. Curaleaf® has remained stable in 4th position and Integro has moved up to 5th place, being in 6th last month. Lyphe Clinic has dropped down to 6th after rising to 3rd place last month after being in 9th place previously.

Reflections

This month’s traffic once again demonstrates the highly competitive nature of cannabis clinics with the top 5 slots accounting for over 60% of the total clinic traffic. Though MedBud’s data is not necessarily representative of how each of these clinics are doing in regards to recurring patient numbers, it is the closest indicator we have.

Plus, it’s clear that when a clinic announces a positive patient initiative, there is a direct correlation with traffic direction (i.e. Alternaleaf rising to 1st place from 5th place last month).

It’s also interesting to see an increased uptake in subscription programmes from clinics. Lyphe announced theirs a few months ago, and now Alternaleaf are the latest to follow and announce one. Across the board, we see this as a positive – anything that can make the associated fees with medical cannabis more accessible and affordable for patients, the better. As such, it will be interesting to observe clinic data over the coming months and whether there will be a continued move in this direction.

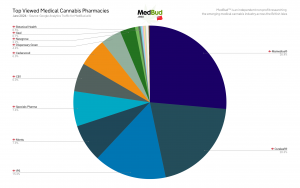

Section 2: UK Medical Cannabis Pharmacies Data

June Pharmacy Rankings

June Pharmacy Rankings

- Mamedica®: 26.4% –

- Curaleaf®: 20.3% –

- IPS: 15.3% –

- Montu: 7.9% +3

- Specials Pharma: 7.4% -1

This month once again we see no changes to the top 3 positions. Montu has risen from 7th to 4th position, pushing down Specials Pharma, CB1 Medical and Cedarwood. Xeal has also risen into a labeled position for the first time.

Reflections

Even more so than the clinics, the top 5 pharmacies account for over 75% of overall traffic. This demonstrates just how unequally distributed patient numbers are likely to be across all of the pharmacies. And of course with vertical integration, the top pharmacies are closely correlated with the top clinics.

It is no surprise that the top 3 pharmacies have remained unchanged for some time. Both Mamedica® and Curaleaf® maintain almost 50% of all traffic, as a result of their aggressive PR strategies. IPS’ 3rd place is a direct result of their distribution agreement with Big Narstie’s products which are dominating the flower market. Montu’s traffic gains this month are also likely attributable to Alternaleaf’s new pricing model, as their default partner pharmacy.

Across the board, there is a bit more consistency with pharmacy rankings – this would suggest that patients are sticking to the same pharmacy or that the top pharmacies are offering the most consistent service and widest formulary.

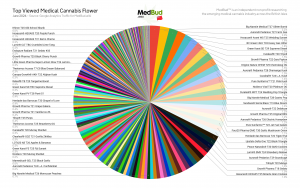

Section 3: Medical Cannabis Flower Data

June Flower Rankings

June Flower Rankings

- Big Narstie Medical T27 Glitter Bomb: 2.15% +4

- Aurora® Pedanios T27 Farm Gas: 1.99% +5

- Hexacan® Avant WS T25 Wedding Sunset: 1.86% +86

- BC Green HGH T33 Heavy Gas Hitter: 1.76% +89

- Green Karat SD T29 Supreme Diesel: 1.53% +69

Big Narstie has retained the top spot for flower, but this month has swapped out Gastro Pop for Glitter Bomb. Now being back in stock, the popular Aurora’s Farm Gas has rejoined the top 5 in second place. T25 Wedding Sunset comes in 3rd place now with Hexaca’s new premium range being released.

The record breaking high THC flower T33 HGH has launched to 4th place and Green Karat’s new T29 Supreme Diesel has taken 5th place; with Peace Naturals dropping entirely from the top 20 after going out of stock.

Reflections

The flower market continues to be incredibly competitive with a whole new set of 5 cultivars taking the top 5 spots this month compared to last. There is a consistent trend with new released or restocked strains jumping to the top.

The graph above demonstrates the sheer amount of available products and no one strain significantly dominates the market. This would suggest that patients month to month do try and are interested in new products. There is also a clear preference for high THC products with the top 5 slots ranging from 25-33% THC.

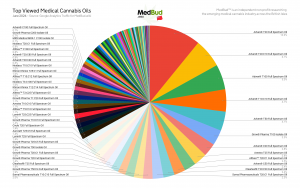

Section 4: Medical Cannabis Oils Data

June Oil Rankings

June Oil Rankings

- Adven® T20 Full Spectrum Oil: 10.89% –

- Adven® T20:C10 Full Spectrum Oil: 6.08% +1

- Adven® T100 Full Spectrum Oil: 5.29% -1

- Adven® T10:C10 Full Spectrum Oil: 4.71% –

- Adven® T50 Full Spectrum Oil: 4.06% –

Medical cannabis oil listings have seen very few changes compared to last month. Curaleaf’s Adven range continues to dominate the oil market taking all 5 spots. Aside from this, Somai Pharmaceuticals new oil medications have recently launched, with one taking 12th place.

Reflections

Very much like last month, there is far less competition in the oil market in the UK, compared to flowers. This is evident in essentially no changes in the oil rankings this month, whereas the top 5 flower products are completely different.

Final Thoughts

June 2024 traffic data continues to offer interesting insight to the UK’s medical cannabis market.

While the overall traffic increase of 1% is modest compared to last month’s 18.5%, it still indicates a positive trend. The significant rise of Alternaleaf in the clinic rankings, fuelled by their new pricing and membership structure, highlights the impact of patient-focused initiatives on clinic popularity. This trend underscores the importance of affordability and accessibility in patient engagement.

Pharmacy rankings have remained stable, with the top pharmacies maintaining their positions and accounting for the majority of traffic. This stability suggests a strong patient loyalty and satisfaction with the services provided by leading pharmacies. The correlation between top clinics and pharmacies, due to vertical integration, emphasizes the strategic value of comprehensive service offerings.

The flower market continues to be highly competitive and dynamic, with new and restocked strains quickly rising to the top. This trend indicates that patients are eager to explore new products, particularly those from Canadian cultivators. Conversely, the oil market shows less volatility, dominated by Curaleaf’s Adven range, reflecting more established patient preferences.

Overall, MedBud’s traffic data provides crucial insights into the evolving dynamics of the UK medical cannabis market. As mainstream media coverage and sector initiatives expand, we can anticipate sustained traffic growth and market development in the coming months.

MedBud.wiki is a registered non-profit organisation tracking the medical cannabis industry across the British Isles, as well as a vocal member of the Cannabis Industry Council.

Thank you for following our analysis. We look forward to continuing to provide detailed insights and updates on the UK medical cannabis market. Your feedback and questions are always welcome:

- info@volteface.me

- access@medbud.wiki