Welcome to our first UK medical cannabis data breakdown for May 2024 in partnership with MedBud.wiki.

In this article we take a close look at the UK medical cannabis stats in May 2024 – examining monthly traffic data, highlighting any interesting trends or patterns to help improve the industries understanding of the market.

This month continued to see strong overall traffic growth on MedBud.wiki with an 18.5% increase in overall traffic in the last 30 days. While exact patient registration numbers are unknown, it is reassuring that we are seeing a significant traffic increase. Are the TV adverts, social media influencers and SEO strategies finally cutting through to the UK population?

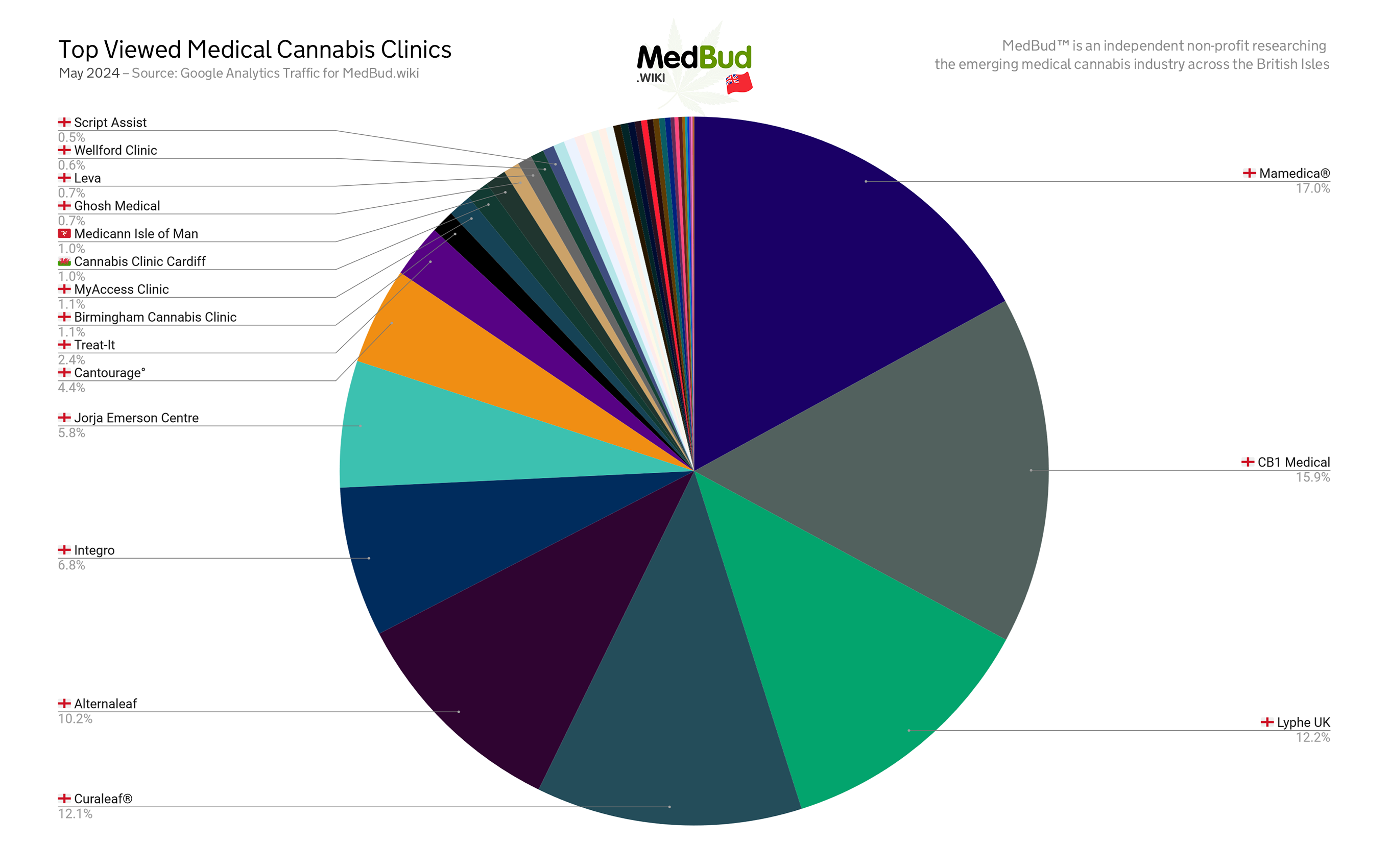

Section 1: UK Medical Cannabis Clinics Data

May Clinic Rankings:

- Mamedica®: 17% –

- CB1 Medical 15.9% –

- Lyphe 12.2% +6

- Curaleaf® 12.1% -1

- Alternaleaf 10.2% -1

Another strong month for Mamedica sees them take the top spot with a 2.7% increase in traffic from April with CB1 Medical not far behind at 15.9%. Lyphe’s new subscription programme and subsequent communications seems to have played a key role in them raising 6 places to number 3 with Curaleaf and Alternaleaf both dropping one place.

One clinic had to be removed due to a vast number of traffic ‘bots’ being sent to the companies page, all with under 1 second engagement time. We have seen the data on this and can confirm it is clearly fake bot traffic. This is the first time we have seen such tactics and approaches used since medical cannabis was legalised in 2018 – thankfully it’s easy to spot and therefore omit from publication data.

Reflections:

The traffic data shows the number of users who want to learn more about a company and explore their offer rather than which clinic currently has the most patients. Regardless, just 5 clinics are responsible for 67.4% of the clinic traffic data, which when you consider that the UK now has 46 clinics, suggests the patient population is heavily skewed to the top 5-6 clinics. Notably, each of the top clinics is highly competitive on pricing for clinical care.

Furthermore the ‘top 5’ are all deploying aggressive SEO marketing strategies, buying each other’s PPC keywords and traffic in an attempt to divert patients to their website. For those starting new clinics in the latter half of 2024 – they had best be prepared to spend and invest big to try and compete with established players.

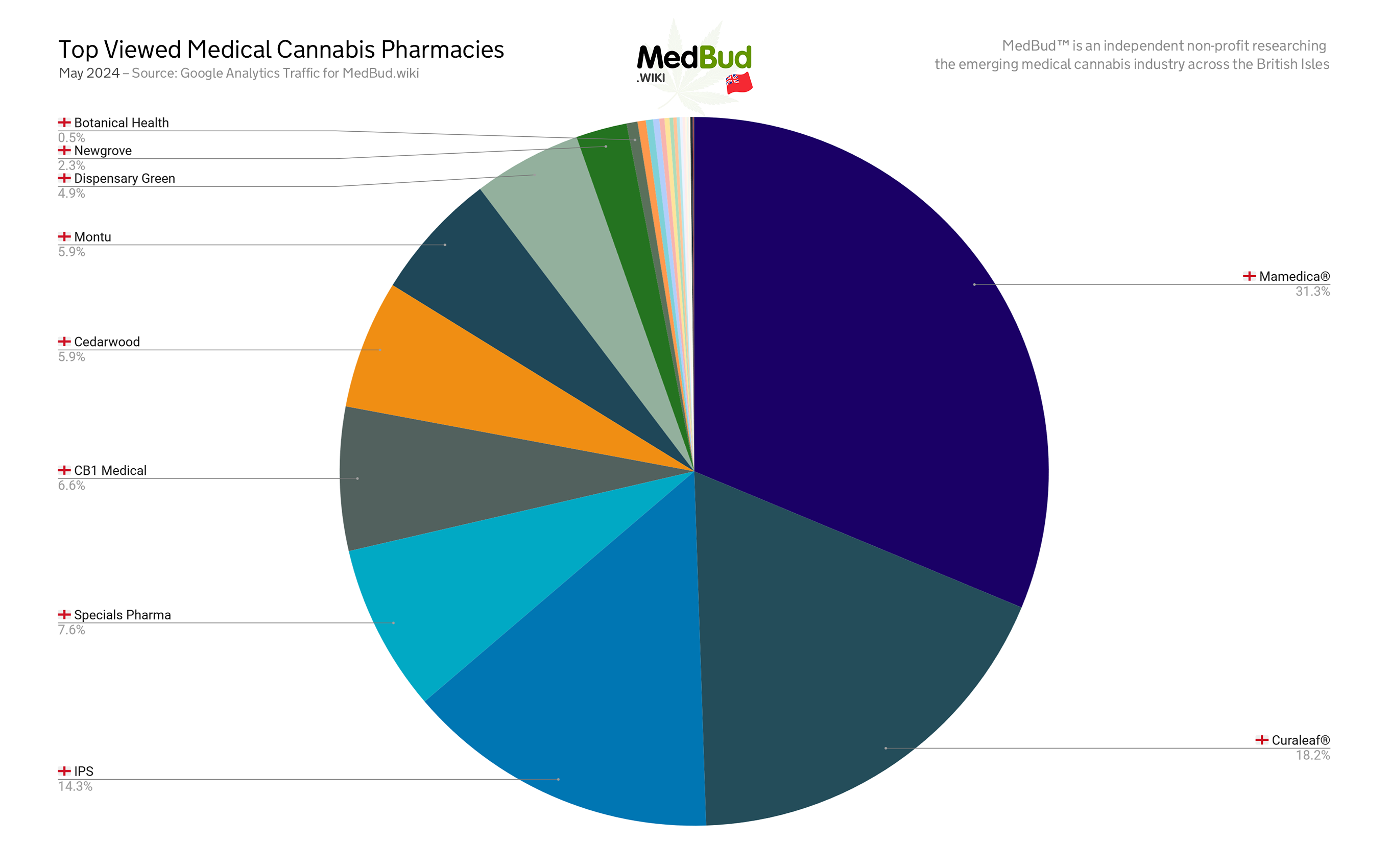

Section 2: UK Medical Cannabis Pharmacies Data

May Pharmacy Rankings:

- Mamedica® –

- Curaleaf® –

- IPS –

- Specials Pharma –

- CB1 Medical –

From April to May there hasn’t been a change to pharmacy rankings. It’s been another strong month for Mamedica leading the way with 31.3% majority of pharmacy traffic. Given their first place clinic slot, it is unsurprising they are leading the way in the pharmacy category. In second place we have Curaleaf at 18.2%, IPS coming in third with 14.3% and Specials Pharma at 7.6%.

Reflections:

Mamedica’s strong PR strategy is likely contributing to their consistent successful traffic. In second and third place we have Curaleaf and IPS, both well-established players well-known brands within the industry. It is therefore understandable that they have a stable and consistent ranking as pharmacies. IPS’ third place ranking is also likely linked to their distribution agreement with Big Narstie’s products, and the successful initial launch of the Peace Naturals range. Their rankings in the flower section (just below) are likely contributing to this.

Uniquely Specials Pharma holds 4th place while not being affiliated with any particular clinic, though having the largest formulary of available medications overall. The pharmacy acts as somewhat of a ‘catch all’ for clinics when patients need access to medication that may not be available through their main affiliated pharmacy.

Overall, we are seeing less fluctuation between pharmacies with a bit more month-to-month consistency on what patients are searching for via MedBud.wiki.

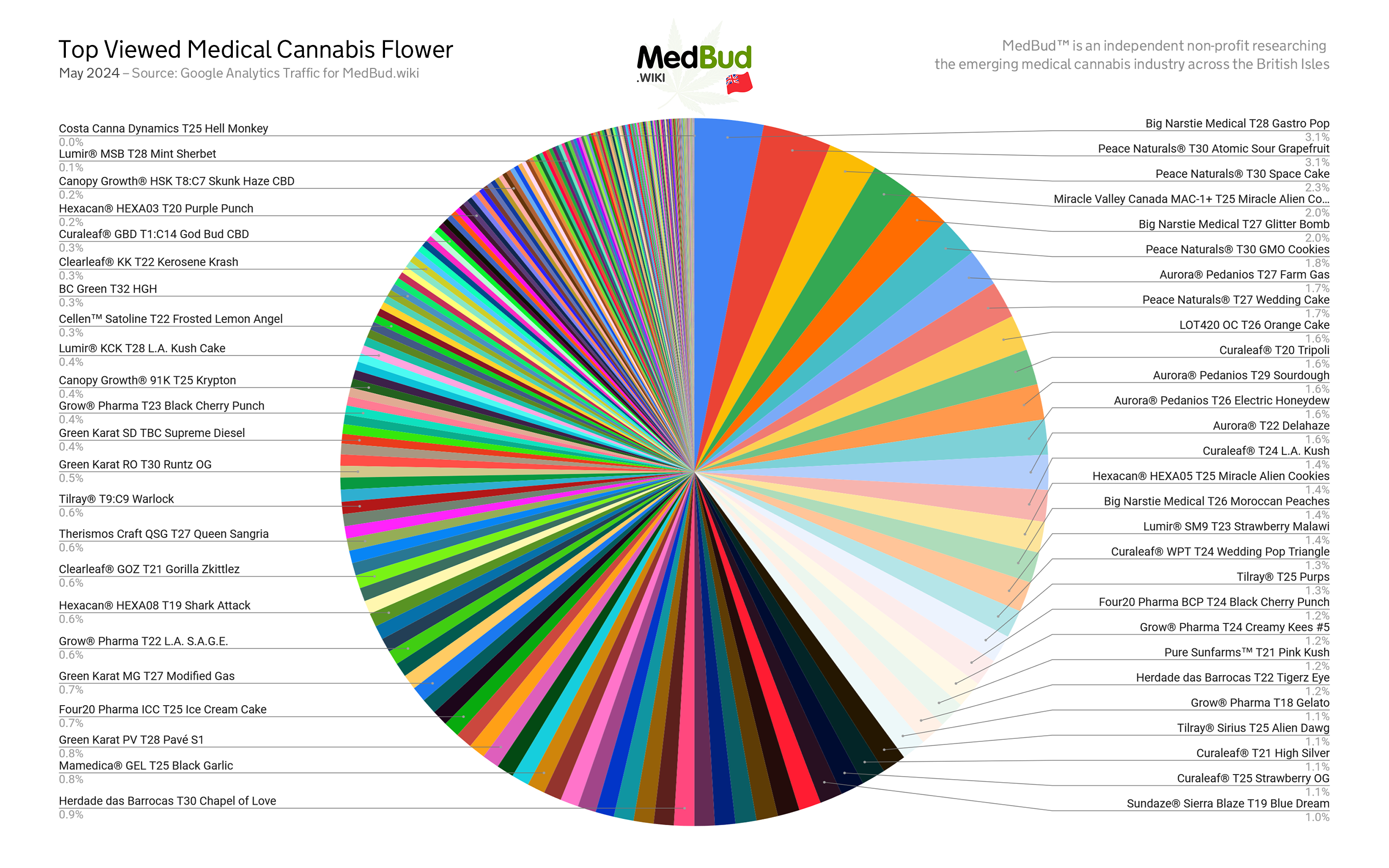

Section 3: Medical Cannabis Flowers Data

Last month’s top flower Big Narstie T27 Glitter Bomb drops to 5th with Big Narstie T28 Gastro Pop taking the top spot. Peace Naturals new range dropped immediately taking 2nd, 3rd, 6th and 8th.

May Flower Rankings:

- Big Narstie Medical T28 Gastro Pop +24

- Peace Naturals® T30 Atomic Sour Grapefruit –

- Peace Naturals® T30 Space Cake –

- Miracle Valley Canada MAC-1+ T25 Miracle Alien Cookies +66

- Curaleaf® T20 Tripoli –

Reflections:

The flower rankings are turbulent, particularly now the number of new cultivars hitting the market increases. New strains hitting the market typically receive the most traffic, even more so if it is an established cultivar.

The MedBud.wiki website is an exceptional resource for patients and one of the only sites in the world where this level of information is presented quickly and without bias. The flower rankings are therefore likely to remain turbulent and dominated by strains which come to the UK market for the first time – and in particular anything with a unique value proposition to patients.

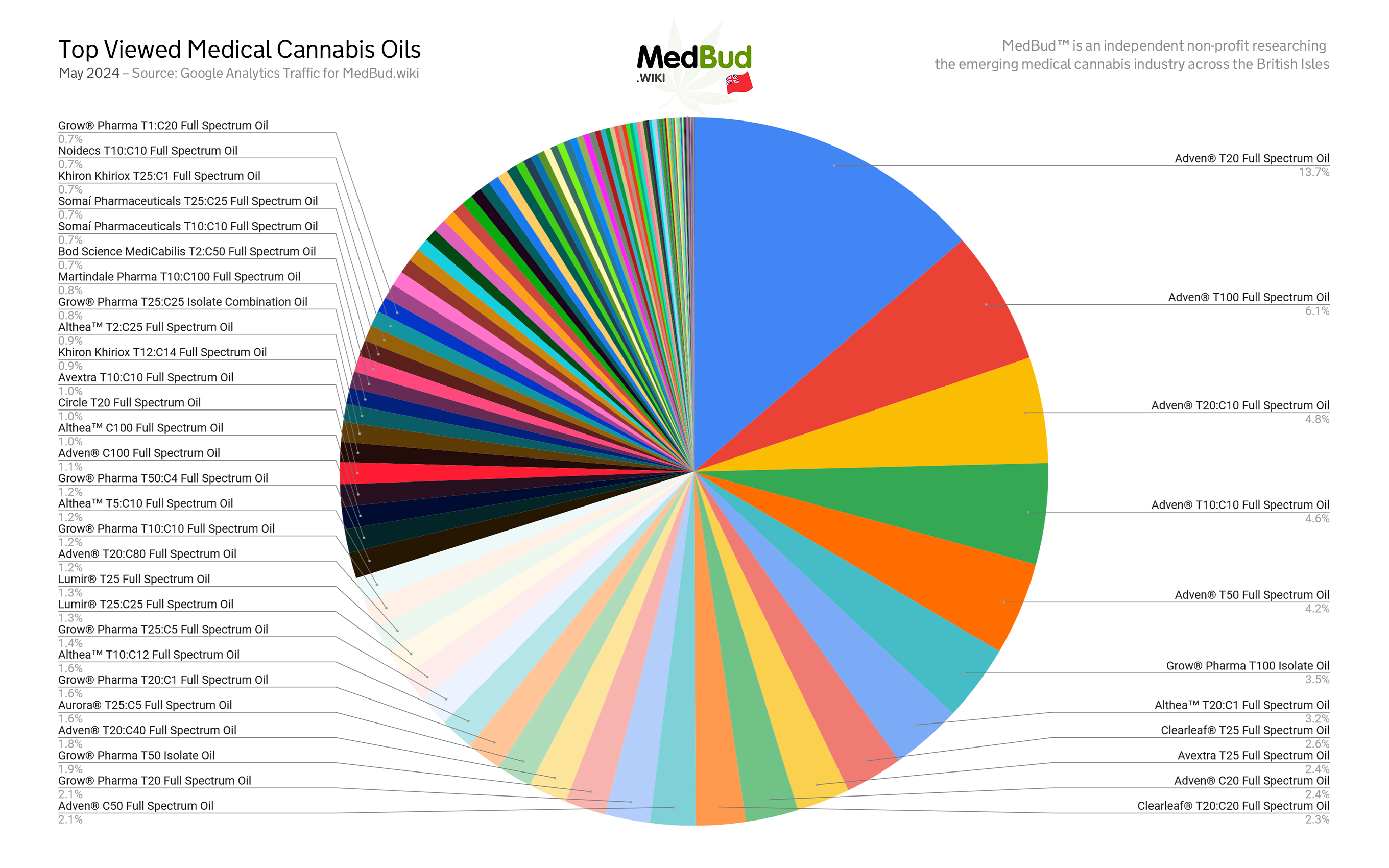

Section 4: Medical Cannabis Oils Data

May Oil Rankings:

- Adven® T20 Full Spectrum Oil –

- Adven® T100 Full Spectrum Oil –

- Adven® T20:C10 Full Spectrum Oil –

- Adven® T10:C10 Full Spectrum Oil –

- Adven® T50 Full Spectrum Oil +1

Compared to the flower market, oils in the UK appear to be less competitive. Adven is leading the oil market across the board taking the top five spots in the rankings. Aside from the top five slots, they also feature in another three out of the top 21. Aside from Adven, key brands that feature prominently in the oil market are Grow Pharma, Althea and Clearleaf.

Reflections:

Although there is a wide variety of oils available in the UK, generally there is less competition when compared to flower. Oil is across the board used more by cannabis-naive patients or patients that have less experience with cannabis.

This may explain why Adven is in the lead. Adven is supplied by Curaleaf, which may explain why they dominate the oil market so heavily, especially with aggressive mainstream media coverage and TV advertisements. This will have allowed them to capture some of the cannabis naive population, resulting in their ability to dominate the oil market.

MedBud.wiki notes that flower medications had over 19 times the total view count of oil medications in May 2024, and also remarks that many brands producing oils seem to struggle with market penetration and adoption, by comparison to flower.

Final Thoughts:

Our main takeaway here is that the overall traffic data increasing again by over 15% is a great sign for the UK market. Collectively as an industry we are waking the UK population to the potential benefits of medical cannabis. While ‘total patient numbers’ are notoriously hard to calculate (and sometimes used to raise money and hope, rather than true data collection), two months of significant traffic increase is something to feel positive about.

The clinic market is incredibly competitive and unfortunately with such competition comes nefarious activities and tactics. While everyone is pulling together to help increase the overall market size it’s important to recognise that while in its infancy, collaboration is key.

It’s understandable that new players in the market may want to be disruptive. However, in a complex regulatory landscape riddled with stigma and medical cannabis still being in its infancy, such a path is not only a lonely one, but fraught with challenges which could be overcome through collaboration. Such collaboration might in the short term come at a cost of market share, but if you are in cannabis for the short term gains, hang-on tight it’s going to be a rough ride.

SEO and PPC battles will remain of high importance to any marketeer in the sector, though we hope the usage of illegal bot farms is representative of a singular poor decision, rather than an on-going strategy. Regardless, we will be back next month for another statistics update, which is stringently pre-screened for any malicious bot traffic attempting to skew data depended upon by the industry and patients alike.

MedBud.wiki is a registered non-profit organisation tracking the medical cannabis industry across the British Isles, as well as a vocal member of the Cannabis Industry Council.

Thanks for reading, questions, reflections and feedback is welcome:

- info@volteface.me

- access@medbud.wiki